wyoming tax rate for corporations

Detailed Wyoming state income tax rates and brackets are available on this page. An S-Corp is not taxed at the same rate as a C-Corporation which is 21 at the time of this writing.

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Wyoming has been consistently ranked as the most tax friendly state in the union.

. Ad The Leading Online Publisher of National and State-specific LLC Legal Documents. Up to 25 cash back Corporate rates which most often are flat regardless of the amount of income generally range from roughly 4 to 10. At 4 the states sales tax is one of the lowest of any state with a sales tax though counties can charge an additional rate of up to 2.

A Wyoming LLC also has to file an annual report with the secretary of state. There are a total. Effective July 1 2021 there will be an increase from 12 to 20 in the collection fee on SalesUse Tax Accounts that have been referred or will be referred to an external.

The annual report fee is based on assets located in Wyoming. We include everything you need for the LLC. Form your Wyoming LLC with simplicity privacy low fees asset protection.

This will cost you 325 for a corporation or an LLC. Form your Wyoming LLC with simplicity privacy low fees asset protection. Ad Our 199 LLC formation service includes Bank Account provides everything you need.

But not all states levy a. Theres good reason for that. The Wyoming income tax has one tax bracket with a maximum marginal income tax of 000 as of 2022.

State corporate income tax rates range from 0 999. The tax is either 60 minimum or 0002 per dollar. An S-Corp can be taxed more or less but avoids double taxation.

Wyoming also does not have a corporate income tax. Wyomings Sales and Use Tax. Wyoming is the least taxed State in America if you figure there is no personal or corporate income tax.

52 rows Most states set a corporate tax rate in addition to the federal rate. Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Personal rates which generally vary.

The sales tax is about. What is the Wyoming corporate net income tax rate. Because your Wyoming corporation income flows through to your personal tax return you must pay self-employment tax also known as FICA Social Security or Medicare tax on your.

Average Sales Tax With Local. We recommend you form a Wyoming LLC or incorporate in Wyoming. Wyoming has no state income tax.

Wyoming has a 400 percent state sales tax a max local sales tax rate of 200 percent and an average combined state and local. A 7 percent corporate income tax on these operations still means that the state has a very low tax burden but if it makes some of these chains locations outside of Cheyenne. Wyoming charges a sales and use tax of 4 for which you will need a license to collect if you sell physical goods andor provide certain types of services.

Wyoming has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 2. Ad Our 199 LLC formation service includes Bank Account provides everything you need.

A Guide On Different Taxes In Usa And Filing Of Corporate Tax In Usa

Corporate Tax Reform In The Wake Of The Pandemic Itep

Business State Tax Obligations 6 Types Of State Taxes

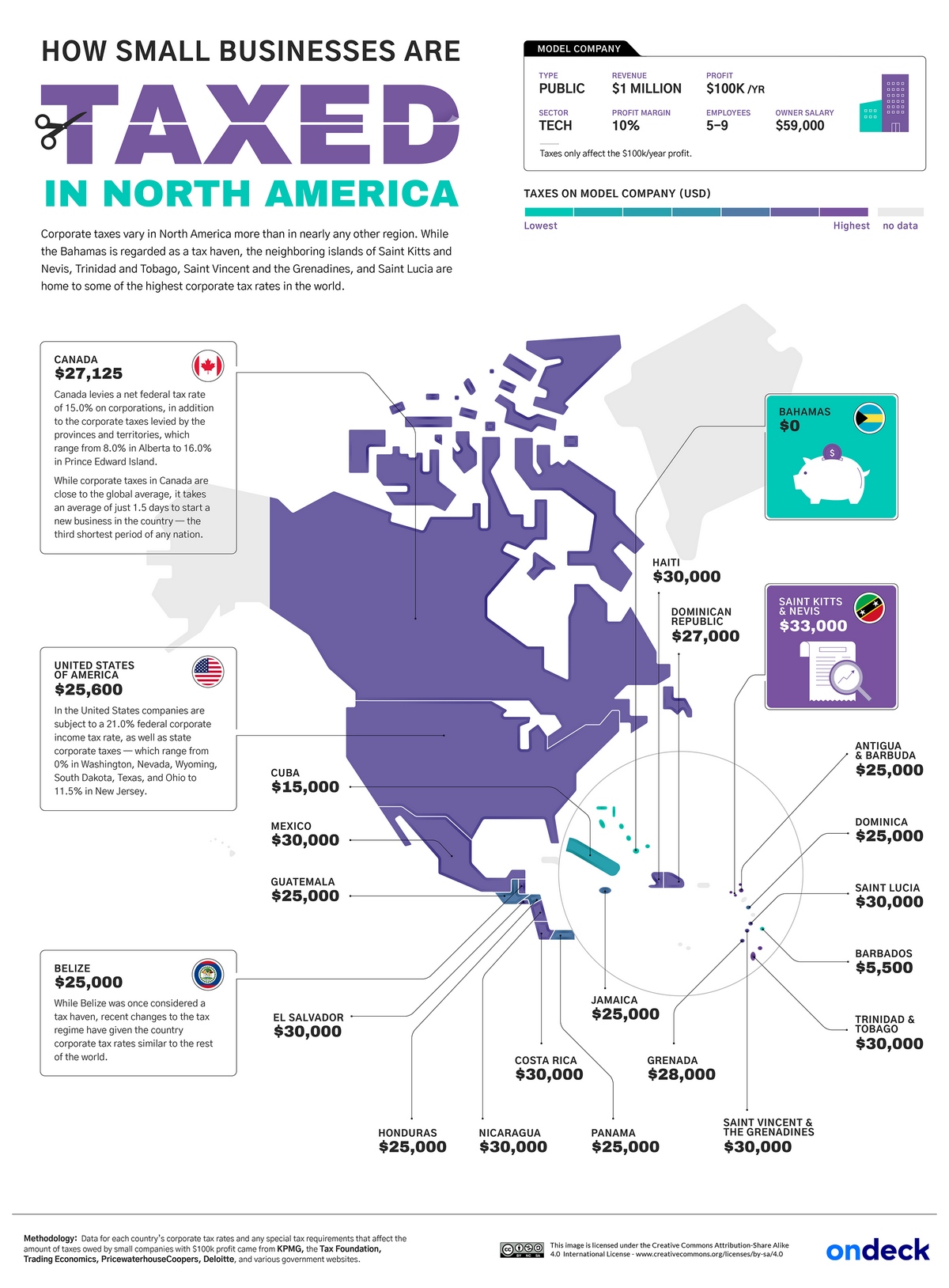

How Do Corporate Taxes For Small Businesses Vary Around The World Vivid Maps

How Do State And Local Corporate Income Taxes Work Tax Policy Center

Corporate Tax Reform In The Wake Of The Pandemic Itep

Corporate Tax Rates By State Where To Start A Business

Oc Individual Vs Corporate Tax Revenue Usa R Dataisbeautiful

Corporate Taxes By State In 2022 Balancing Everything

How Do State And Local Corporate Income Taxes Work Tax Policy Center

Legislative Corporate Income Tax Discussion Sparks Tension Wyoming Public Media

State Corporate Income Tax Rates And Brackets Tax Foundation

Corporate Taxes By State Where Should You Start A Business Hourly Inc

Share Of State Taxes Contributed By Corporate Income Tax Download Table

Corporate Tax In The United States Wikiwand

State Corporate Taxes Improve The Tax Burden On Corporate Earnings Tax News Daily

What Is An S Corporation S Corp Requirements For Formation

How Do Corporate Taxes For Small Businesses Vary Around The World Vivid Maps

How The Corporate Amt Affects Different Industries Tax Policy Center